India’s push to build large-scale battery energy storage is entering a more structured phase, and the Ministry of Power’s latest directive makes that clear. By mandating a minimum 20% local content for all Battery Energy Storage System projects supported under the Viability Gap Funding scheme, the Centre has drawn a firm line on how public money should be deployed in the storage sector.

The order, addressed to 15 beneficiary states and NTPC, comes after several states sought exemptions from the Public Procurement (Preference to Make in India) norms. Their argument was straightforward: domestic battery manufacturing is limited, costs remain high, and project timelines are tight. The ministry’s response was equally clear—there will be no carve-outs. A uniform local content threshold will apply across all VGF-supported BESS projects funded through the Power System Development Fund.

This decision underscores the Centre’s intent to avoid a fragmented policy landscape. Allowing exemptions on a case-by-case basis could have weakened the credibility of Make in India provisions and created regulatory uncertainty for manufacturers and investors. Uniformity, in contrast, provides predictability, even if it constrains short-term flexibility.

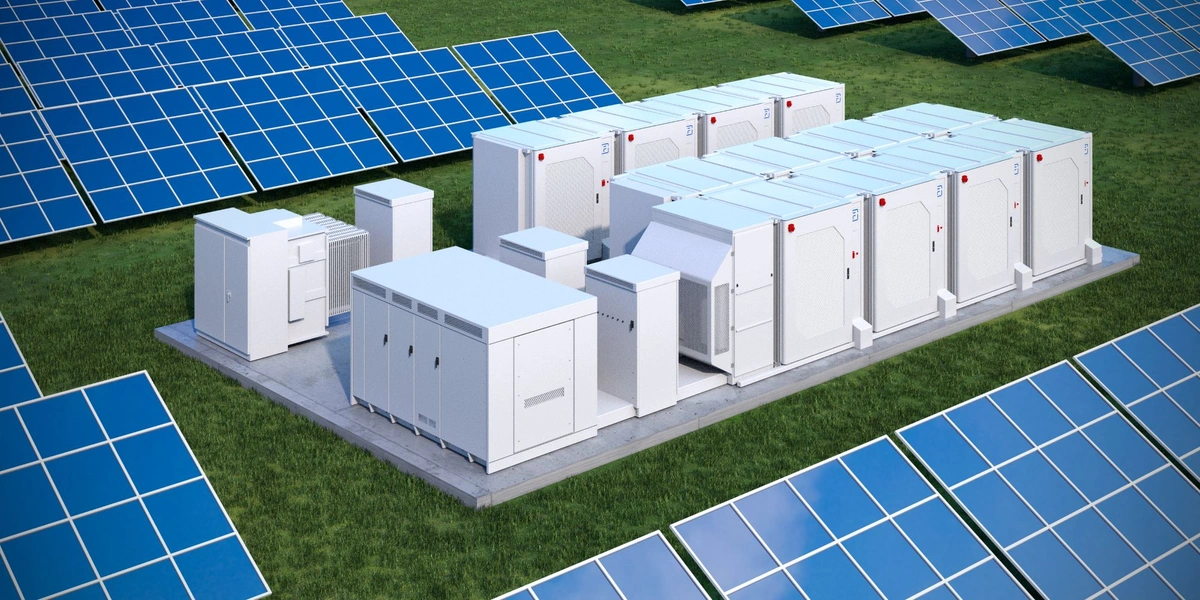

The timing of the directive is critical. India is on the cusp of deploying storage at scale to support its renewable energy ambitions. With solar and wind capacity rising rapidly, the absence of sufficient storage has emerged as one of the biggest structural risks to grid stability.

VGF-backed projects are expected to anchor early deployments and demonstrate commercial viability. By linking these projects to domestic value addition, the government is effectively using storage as a lever for industrial policy.

For developers, the rule introduces new compliance considerations. Bid structures will need to account for domestic sourcing, certification of local content and potential supply-chain adjustments. While this may marginally increase costs in the short term, it also creates opportunities for Indian suppliers of power electronics, control systems, enclosures and EPC services.

Importantly, the ministry has defined local content as a share of total project cost, not just battery cells. This distinction is crucial. It recognises that India’s cell manufacturing capacity is still evolving, while other segments of the storage value chain are more mature. The approach allows projects to move forward without being hostage to cell availability, while still ensuring meaningful domestic participation.

For states, the directive signals a shift in how energy transition funding will be governed. VGF is no longer just a financial support mechanism; it is now a policy instrument tied to national manufacturing goals.

States implementing storage projects will need to align procurement strategies accordingly, even if it requires additional coordination and capacity-building.

The broader implication is that energy storage is being treated as strategic infrastructure, not just a power-sector add-on. Batteries sit at the intersection of energy security, industrial competitiveness and geopolitics. Import dependence in this sector carries risks far beyond price volatility, including supply disruptions and strategic vulnerability.

While concerns about execution challenges are valid, the 20% threshold suggests a pragmatic balance. It neither delays storage rollout nor ignores domestic capability gaps. Instead, it nudges the market toward gradual localisation, using public funding as the catalyst.

As India prepares for larger and more complex storage tenders, this directive sets the tone.

The message from the Ministry of Power is clear: the energy transition will move fast, but it will also be built at home.